refleksiya-absurda.ru

Community

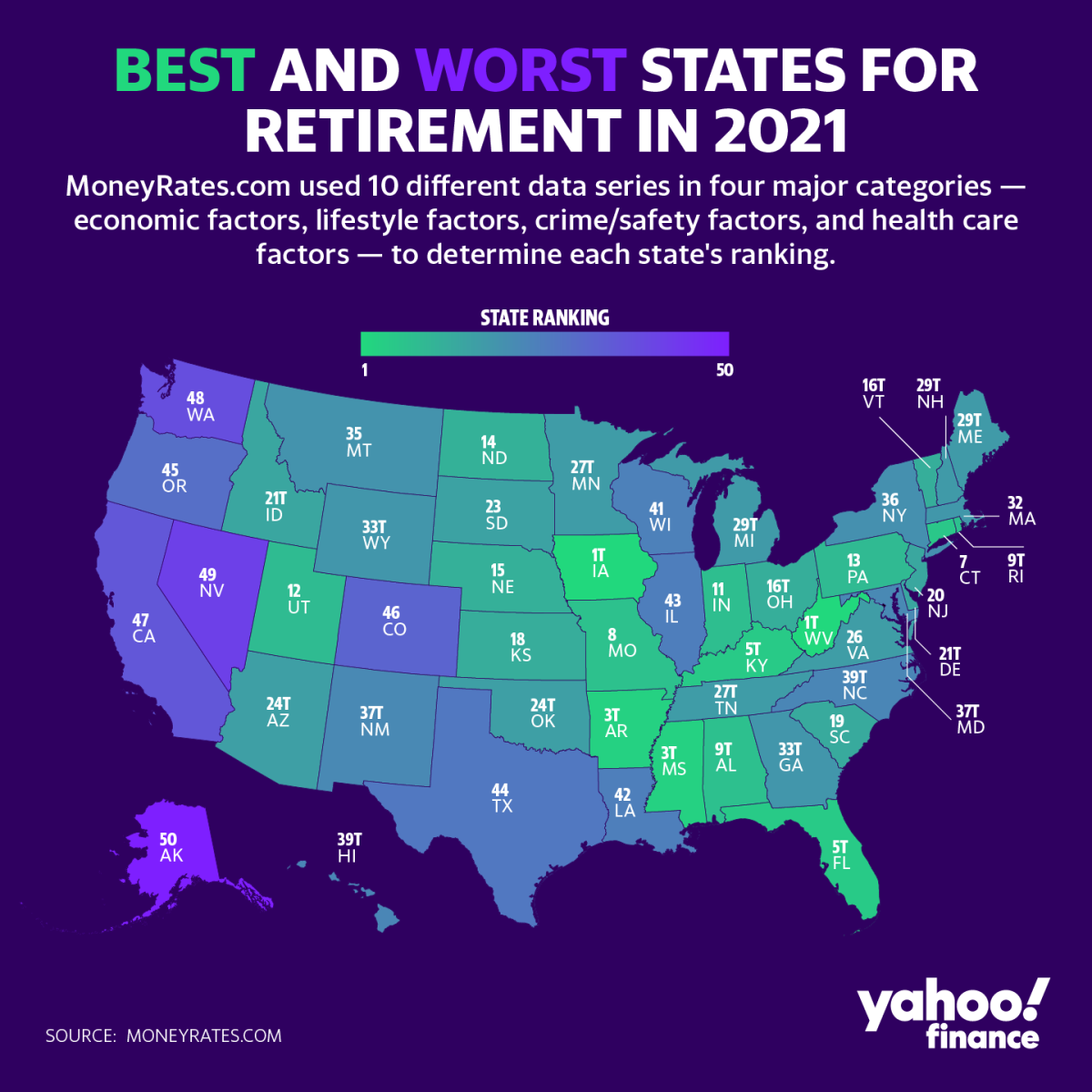

States That Are Good To Retire In

Most retirees choose to relocate to the Mountain West region, which stretches from Arizona to Wyoming, the South and a couple states in the Northeast. Where you'll be retiring in · For a long time, retiring to Maine meant log cabins, few neighbors, and plenty of solitude. · Portland also serves as a central. U.S. News & World Report ranks places to retire in the U.S. based on factors like health care, happiness and housing affordability. If Florida is already your first choice for retirement, you are not alone. According to a study, roughly 12% of all retirees who moved out of another state. U.S. News & World Report ranks places to retire in the U.S. based on factors like health care, happiness and housing affordability. With its low cost of living, Kansas in general rates as one of our 10 best states for retirement. And the capital city is particularly affordable. The median. Of all the states that won't take a cut of traditional retirement income, Mississippi has the lowest property taxes, with a median tax bill of $1, So. You'd be in good company · North Carolina is a moderately tax-friendly state · Housing is fairly affordable in North Carolina · Property taxes are lower than. What States Are Retirees Moving to Right Now? Florida remained the top choice among , U.S. retirees who moved in , at %. · What States Are. Most retirees choose to relocate to the Mountain West region, which stretches from Arizona to Wyoming, the South and a couple states in the Northeast. Where you'll be retiring in · For a long time, retiring to Maine meant log cabins, few neighbors, and plenty of solitude. · Portland also serves as a central. U.S. News & World Report ranks places to retire in the U.S. based on factors like health care, happiness and housing affordability. If Florida is already your first choice for retirement, you are not alone. According to a study, roughly 12% of all retirees who moved out of another state. U.S. News & World Report ranks places to retire in the U.S. based on factors like health care, happiness and housing affordability. With its low cost of living, Kansas in general rates as one of our 10 best states for retirement. And the capital city is particularly affordable. The median. Of all the states that won't take a cut of traditional retirement income, Mississippi has the lowest property taxes, with a median tax bill of $1, So. You'd be in good company · North Carolina is a moderately tax-friendly state · Housing is fairly affordable in North Carolina · Property taxes are lower than. What States Are Retirees Moving to Right Now? Florida remained the top choice among , U.S. retirees who moved in , at %. · What States Are.

Basically these states have no income tax - Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington and Wyoming. After that. Best and Worst States To Retire in , Ranked From Best to Worst · 1. West Virginia · 2. Maine · 3. Kentucky · 4. Wyoming · 5. Alabama · 6. Pennsylvania · 7. North. For those of us who want to retire in the U.S., there are nine states that have no state income taxes: Alaska, Florida, Nevada, New Hampshire, South Dakota. The 11 states that tax Social Security are Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, Rhode Island, Utah and Vermont. Acts' Best States for Retirement · Alabama: There's no denying that Alabama is a southern state, and that's exactly why many retirees find it so charming. 9 Best States to Retire · 1. Alabama · 2. Delaware · 3. Florida · 4. Georgia · 5. Maryland · 6. New Jersey · 7. North Carolina · 8. Pennsylvania. For many people who love California, leaving the state to retire is not such a good idea from a tax perspective, no matter how trendy it is to consider escaping. Florida is also a popular retirement spot due to its diverse lifestyles. The state offers everything from wildlife and beaches to major cities and theme parks. The Arizona State Retirement System (ASRS) has been selected as one of the Top Places to Work in Arizona for ! The recognition comes from Best Companies. Your Tennessee Consolidated Retirement System (TCRS) is recognized as one of the top 3 strongest pension funds in the United States by Standard & Poor's (S&P). View Complete List · View Complete List · View Complete List · View Complete List · Fintech 50 · View Complete List · Best Places to Retire · View Complete. Based on these factors, South Dakota, Hawaii, and Georgia are the best states for retirement. Below are the ten best states for retirement. Top 5 Best States to Retire in the United States · 5. Colorado · 4. Michigan · 3. Florida · 2. Tennessee · 1. Georgia. Here is a look at some of the best retirement cities in Washington State. These spots were evaluated based on affordability, tax burden, accessibility to. refleksiya-absurda.ru released its ranking of the best and worst states to live in retirement, putting Minnesota in the number 5 spot. States were ranked based on a. The states with the lowest living costs for retirees include Mississippi, Oklahoma, Kansas, Alabama, and Georgia. An official website of the United States government. Here's how you know It may not replace all your income so it's best to identify other ways to pay for. Best Warm States to Retire in the United States · Florida: The Sunshine State · Georgia: Southern Charm and Mild Weather · North Carolina: Balance of Beauty and. The best states to live in have a combination of low taxes and incredible weather. California is awesome, but our taxes are horrendous. Hawaii is also amazing. The best state to retire in for taxes depends on your budget, lifestyle, and values. Find out more about factors retirees should weigh before relocating.

Home Equity Interest Rates Today

Rates are as low as % APR and % for Interest-Only Home Equity Lines of Credit and are based on an evaluation of credit history, CLTV (combined loan-to. Home Equity Loan · 5 Year Equity Loan-to-Value up to 80%. % · 10 Year Equity Loan-to-Value up to 80%. % · 15 Year Equity Loan-to-Value up to 80%. % · What are today's average interest rates for home equity loans? ; Home equity loan, %, % – % ; year fixed home equity loan, %, % – % ; Today's Home Equity Loan rates ; 5 years, %, % ; 10 years, %, % ; 15 years, %, %. Home Equity Loan Annual Percentage Rates (APRs) currently range from %, depending on several factors, including occupancy type, lien position, credit. Home Equity Loan 85% Loan Value Rates ; Term. Fixed APR* with Automatic Payment · Payment per $1, ; 60 months. %. $ ; months. %. $ Current Home Equity Loan Rates. Term Length Options: Rate Range: APR Disclosure. Year Fixed Rate. % - % APR. Year Fixed Rate. As of 7/27/, the variable rate for home equity credit lines of $20,$,, with a combined-loan-to-value ratio (CLTV) up to 75% range from % APR. You could enjoy a low variable introductory rate on a home equity line of credit. Now: % Special Introductory variable APR. Rates are as low as % APR and % for Interest-Only Home Equity Lines of Credit and are based on an evaluation of credit history, CLTV (combined loan-to. Home Equity Loan · 5 Year Equity Loan-to-Value up to 80%. % · 10 Year Equity Loan-to-Value up to 80%. % · 15 Year Equity Loan-to-Value up to 80%. % · What are today's average interest rates for home equity loans? ; Home equity loan, %, % – % ; year fixed home equity loan, %, % – % ; Today's Home Equity Loan rates ; 5 years, %, % ; 10 years, %, % ; 15 years, %, %. Home Equity Loan Annual Percentage Rates (APRs) currently range from %, depending on several factors, including occupancy type, lien position, credit. Home Equity Loan 85% Loan Value Rates ; Term. Fixed APR* with Automatic Payment · Payment per $1, ; 60 months. %. $ ; months. %. $ Current Home Equity Loan Rates. Term Length Options: Rate Range: APR Disclosure. Year Fixed Rate. % - % APR. Year Fixed Rate. As of 7/27/, the variable rate for home equity credit lines of $20,$,, with a combined-loan-to-value ratio (CLTV) up to 75% range from % APR. You could enjoy a low variable introductory rate on a home equity line of credit. Now: % Special Introductory variable APR.

Check rates for a Wells Fargo home equity line of credit with our loan calculator Home Equity. New home equity lines of credit are currently unavailable. Check today's home equity loan rates ; Up to 80% LTV, % ; % - % LTV, % ; % - % LTV, % ; % - % LTV, %. Fixed Rate, Fixed Term Loan · % · $ ; Home Equity Loan · % · $ ; Energy Efficiency Home Equity Loan · % · $ Introductory rate of % APR applies to new 30 Year home equity lines-of-credit opened on or after January 1, and does not apply to refinances of. Current Home Equity Loan Rates ; $25, % ; $50, % ; $, % ; $, %. After the introductory period, the APR can range from % to %. Approval and rate may vary based on credit history, term and security offered. Minimum. Current Home Equity Loan Rates ; % · % · Home Equity Loans ($K, Mo) · %. Home equity loan rates ; Owner-Occupied HELOC (variable)* - 6-Month introductory rate - Rate for the remainder of the term, % %, % % ; Second. Rates as low as % APR**. For loan amounts of $50, and up. Apply Now. 5 Year Term. APR as. After the 9 months, the rate will be the standard approved variable rate currently ranging between % to % APR. Rates will fluctuate based on changes to. Average overall rate: %; year fixed home equity loan: %; year fixed home equity loan: %. As of Aug. 26, the average rate on a home equity loan overall was %, unchanged from the previous week's rate. The average rate on year fixed. The target range for the federal funds rate remains high, clocking in at % to %. Learn more: Compare current mortgage interest rates. The Fed has. Some of our top picks for the best home equity loan rates are from Discover (%), Navy Federal Credit Union (%), Bethpage Federal Credit Union (%). everyday equity line of credit ; up to 36 months (rates as low as), % ; 37 to 60 months (rates as low as), % ; 61 to 84 months (rates as low as), % ; KEMBA Advantage rate as low as % APR and everyday rate as low as % APR with a loan amount greater than $35, Rates accurate as of July 1, and. Home Equity Rates ; 5 years, %, % ; 10 Years, %, % ; 15 Years, %, % ; 20 Years, %, %. Maximum APR is %. (c) Fixed rate may vary based on your credit history, term, and loan to home value. % APR minimum good on. Rates are as low as % APR and are based on an evaluation of credit history, CLTV (combined loan-to-value) ratio, loan amount, and occupancy, so your rate. Loan Payment Example: A $20, fixed rate home equity loan at % APR* for a month term would have a $ monthly payment. Loan Calculators. What Works.

How To Build A Digital Wallet

How do I make a mobile payment app? To create a digital wallet, start with market research and identification of key trends in the industry. After you have a. It is becoming standard to figure out how to make a website and embark on website monetization with a site that will accept diverse forms of transactions—from. Step-by-Step Guide to Building a Digital Wallet · Define the Wallet's Purpose and Features: · Design the User Interface: · Develop Backend. eWallet & payments software solutions we can build for you: · Core wallet & transaction engine · Open and closed wallets · Mobile wallet integration · P2P money. In this article, we're going to explore the digital wallets – a commodity fintech solution that is no longer nice-to-have but must-have to complete today. A digital wallet lets you make payments in stores, online, or via an app with just one wave—or tap—of your smartphone. But how do you set your digital wallet up. How to set up your Digital Wallet To start, locate the wallet app on your smartphone—most are already installed—then enter your credit or debit card. You can save your payment cards on Google Pay Wallet and use it in stores or to make secure online purchases. How to Make a Digital Wallet App? · SDK option #1: Mastercard Mobile Payment SDK · SDK option #2: PayPal Mobile SDKs · SDK option #3: Simplify Commerce mobile. How do I make a mobile payment app? To create a digital wallet, start with market research and identification of key trends in the industry. After you have a. It is becoming standard to figure out how to make a website and embark on website monetization with a site that will accept diverse forms of transactions—from. Step-by-Step Guide to Building a Digital Wallet · Define the Wallet's Purpose and Features: · Design the User Interface: · Develop Backend. eWallet & payments software solutions we can build for you: · Core wallet & transaction engine · Open and closed wallets · Mobile wallet integration · P2P money. In this article, we're going to explore the digital wallets – a commodity fintech solution that is no longer nice-to-have but must-have to complete today. A digital wallet lets you make payments in stores, online, or via an app with just one wave—or tap—of your smartphone. But how do you set your digital wallet up. How to set up your Digital Wallet To start, locate the wallet app on your smartphone—most are already installed—then enter your credit or debit card. You can save your payment cards on Google Pay Wallet and use it in stores or to make secure online purchases. How to Make a Digital Wallet App? · SDK option #1: Mastercard Mobile Payment SDK · SDK option #2: PayPal Mobile SDKs · SDK option #3: Simplify Commerce mobile.

User Side Panel: · Straightforward and Interactive UI · User Registration · Coordination of Bank Account · Wallet TopUp / Add Money · Send Money · Passbook. Digital wallet app development features Let users seamlessly register and log in via email, phone number, FaceID, fingerprints, etc. Give users the. Custom Mobile Wallet App. Build highly customized mobile wallet apps with advanced level features like face ID unlock, biometric unlock, digital it management. Digital wallets are a great way to virtually load a physical card into a mobile app – and store its value for fast, easy access at the point of purchase. 1. First research on all aspects of developing an e-wallet app. · 2. Collect the information about cost estimation, features, customer needs. To make a mobile payment, the user holds their smartphone close to the contactless terminal. The steps to make a payment through a digital wallet app How does a. The Essentials of Digital Wallet App Development · Transaction History and Notifications · Transfer Money to/from the Bank Accounts · Bill Payments · Management. A digital wallet (or e-wallet) is a type of software that allows buyers to make quick digital transactions by securely storing their payment and password. This tutorial will explain how to use the Ledgers API for a digital wallet. In this example, we will assume you are building a service called SendCash that. How to set up your Digital Wallet To start, locate the wallet app on your smartphone—most are already installed—then enter your credit or debit card. An application for conducting financial transactions on mobile devices is known as a digital wallet (or electronic wallet). It securely stores your passwords. A Step-by-Step Guide to Launch a Digital Wallet · Step 1. Discovery · Check for Compliance · Conduct Market Research · Step 2. Choose the Required. Step 1: Select a software wallet app. · Step 2: Download the wallet app to your phone or computer. · Step 3: Create an account. · Step 4: Transfer your assets. Coinbase SDK: This cross-platform Java library aids developers in creating customized crypto wallets, akin to Coinbase, for both Android and iOS. How to Develop a Digital Wallet Step by Step? · Step 1: Hire a Professional Team · Step 2: Choose the Type of Wallet · Step 3: Narrow Your Target Audience and. A digital wallet, also known as an e-wallet or mobile wallet, is an electronic device, online service, or software program that allows one party to make. Steps to build your ewallet app · 1. Define the App's Objectives and Target Audience · 2. Market Research and Competitor Analysis · 3. Develop a Detailed. Creating a Wallet: No wallet, no money. · Offer 1: If user A sends money to user B and they end up having the same balance, both get a bonus! A Digital Wallet or e-wallet is a secure and quick way to pay with your phone or mobile device. Learn more about Digital Wallets and how to use one with.

Responsible Money Management

By understanding the importance of financial responsibility, building a solid financial foundation, implementing strategies for responsible spending, managing. The five principles of financial literacy enable you to use money wisely, make informed decisions about your finances, create budgets, manage debt and plan. 1. Create a budget: Making a budget is the first and the most important step of money management. · 2. Save first, spend later: · 3. Set financial goals: · 4. By understanding the importance of financial responsibility, building a solid financial foundation, implementing strategies for responsible spending, managing. The Federal Government has a fundamental responsibility to be effective stewards of the taxpayers' money. We must be responsible with money that comes in to the. You can keep track of your money by setting up three bank accounts: one for bills, one for spending, and one for savings. Money Management Basics · Figure out your income sources · Get clear on your priorities, needs, and wants · Create a budget · Create a no-stress plan for paying. Families need to keep control of their finances to make life flow smoothly. The same is true in spades for organizations. In order to manage money properly, you. Arranging to formally manage someone's money for them is a big step – both for you and the person you're helping. By understanding the importance of financial responsibility, building a solid financial foundation, implementing strategies for responsible spending, managing. The five principles of financial literacy enable you to use money wisely, make informed decisions about your finances, create budgets, manage debt and plan. 1. Create a budget: Making a budget is the first and the most important step of money management. · 2. Save first, spend later: · 3. Set financial goals: · 4. By understanding the importance of financial responsibility, building a solid financial foundation, implementing strategies for responsible spending, managing. The Federal Government has a fundamental responsibility to be effective stewards of the taxpayers' money. We must be responsible with money that comes in to the. You can keep track of your money by setting up three bank accounts: one for bills, one for spending, and one for savings. Money Management Basics · Figure out your income sources · Get clear on your priorities, needs, and wants · Create a budget · Create a no-stress plan for paying. Families need to keep control of their finances to make life flow smoothly. The same is true in spades for organizations. In order to manage money properly, you. Arranging to formally manage someone's money for them is a big step – both for you and the person you're helping.

Your students will learn about managing money wisely. These resources will help them build a strong foundation for a financially responsible future. An allowance can be a great first step in showing your kids how to manage money. For young children, you may want to adopt a three-prong approach. How does it. Be aware of your total indebtedness. Knowing your finances involves another skill in basic money management: tracking. Track your income, your spending, and. Money management tip 1: Understand income taxes · Money management tip 2: Start saving for long-term financial goals · Money management tip 3: Make a budget. Rule 1: Plan Your Future. Rule 2: Set Financial Goals. Rule 3: Save Your Money. Rule 4: Know Your Financial Situation. Rule 5: Develop a Realistic Budget. You can keep track of your money by setting up three bank accounts: one for bills, one for spending, and one for savings. A finance committee may be responsible for coordinating and reviewing the budget which has been prepared by staff, but it is the board that is ultimately. The main areas to manage your money are budgeting, managing spending, saving, and getting out of debt. BUDGETING. We help consumers create, restore, and maintain a life of financial wellness. Our nonprofit programs are designed to educate, motivate, and liberate. Download a financial management app that connects to your banks, credit card and investment accounts (Disclaimer, I work for one) and observe. Build an emergency safety net. Many financial advisors suggest saving up to six months of living expenses in case of an emergency. If you can't realistically. Better Money Habits® offers free, easy-to-understand tools and resources that are available to all, helping people make sense of their money and take action to. Practicing financial responsibility is key to living a healthy financial life. Living within your means is essential to being financially responsible. The number one rule of responsible credit use is to always pay your bills on time! Late or missed payments have a big impact on your ability to secure new. IMCU provides a wide range of child- and parent-friendly solutions for teaching financial responsibility and building effective habits for saving, spending, and. Exercise patience and self-control with your finances. If you wait and save money for what you need, you will pay with cash or a debit card to deduct money. Financially responsible individuals prioritize saving and make it a habit. Debt management: Responsible financial behavior involves managing. Being financially responsible means you have a process for managing your money that is productive and in your best interest overall. An allowance can be a great first step in showing your kids how to manage money. For young children, you may want to adopt a three-prong approach. How does it. 1. Live within your means. · 2. Know how to budget. · 3. Save for the future. · 4. Learn how to control your spending habits. · 5. Get your debt under control.

What Is Not Covered By Travel Insurance

What Is Not Covered by Travel Insurance? · A traveler's pre-existing health conditions · Civil and political unrest at the traveler's destination · Pregnancy and. Most travel insurance policies will not cover you for terrorism or the threat of war. It is important you check with your travel insurance provider as to. Generally, coverage extends to situations that are out of your control, including death in the family, natural disasters, unexpected work obligations, new. Offered as an add-on to many insurance policies, this coverage lets you cancel your trip for a reason not covered within a typical trip cancellation benefit. You can use the cancel for any reason to cover flight and trip costs that are prepaid, nonrefundable, and not already included as a "covered reason" under trip. What are some travel exclusions? · Non-Emergency services · Child born during the Covered Trip · Intentional self-inflicted injury · Abuse of alcohol, drug, or. The insurance policy may not cover you if a known, or existing, condition — such as a heart condition or asthma — acts up and requires you to seek medical. Depending on the policy, trip cancellation insurance might not cover any medical care you need overseas, so you may need a separate travel health insurance. Travel insurance policies cover some incidences of tour operator defaults due to financial issues. Look into how that's handled before booking your trip. How. What Is Not Covered by Travel Insurance? · A traveler's pre-existing health conditions · Civil and political unrest at the traveler's destination · Pregnancy and. Most travel insurance policies will not cover you for terrorism or the threat of war. It is important you check with your travel insurance provider as to. Generally, coverage extends to situations that are out of your control, including death in the family, natural disasters, unexpected work obligations, new. Offered as an add-on to many insurance policies, this coverage lets you cancel your trip for a reason not covered within a typical trip cancellation benefit. You can use the cancel for any reason to cover flight and trip costs that are prepaid, nonrefundable, and not already included as a "covered reason" under trip. What are some travel exclusions? · Non-Emergency services · Child born during the Covered Trip · Intentional self-inflicted injury · Abuse of alcohol, drug, or. The insurance policy may not cover you if a known, or existing, condition — such as a heart condition or asthma — acts up and requires you to seek medical. Depending on the policy, trip cancellation insurance might not cover any medical care you need overseas, so you may need a separate travel health insurance. Travel insurance policies cover some incidences of tour operator defaults due to financial issues. Look into how that's handled before booking your trip. How.

Disease avoidance: If you decide not to travel because it would raise your risk of contracting COVID, your insurance policy won't cover you. · Stay-at-home. What does travel insurance not cover? · Extreme sports and activities: High-risk sports may not be covered unless you buy extra coverage. · Alcohol and drug-. Trip cancellation insurance reimburses you for the pre-paid, non-refundable portion of your trip costs (up to the covered amount) if you need to cancel your. What is travel insurance? · Trip cancellation · Trip delay · Trip interruption · Baggage and personal effects · Emergency medical evacuation · Accident and sickness. Unforeseen events that travel insurance does not cover · War (declared or undeclared), acts of war, military duty · Civil disorder or unrest (unless expressly. But one mistake people often make is thinking that travel insurance covers everything. It doesn't. Travel insurance does not cover losses that arise from. Travel insurance does not cover all potential cancellations, interruptions, travel mishaps, or medical emergencies. Before you depart on your trip—and ideally. Travel insurance policies typically exclude epidemics and pandemics as these as generally known events. Travel insurance policies similarly do not cover. What Does Travel Insurance Not Cover? · Costs associated with preexisting health conditions, pregnancy complications, or mental health issues · Injury costs after. Coverage typically includes reimbursement for non-refundable expenses and the additional costs you might incur to arrange alternative transportation. The. Travel insurance does not cover losses that arise from expected or reasonably foreseeable events or problems — even if that event or problem is listed as a. Most travel insurance plans include trip cancellation insurance and travel medical insurance. What is covered, and how much, varies by plan, so it's important. As for typical exclusions, situations such as pre-existing conditions, pregnancies, known events, etc will not be covered. It is important to. Travel insurance covers lost money from canceled trips, emergency medical expenses, evacuation costs, baggage & delays, and 24/7 assistance. Most policies will cover you for loss or theft of your belongings and valuables, but not if you leave them unattended or in an unsecure location or with. Most do not provide coverage, and Medicare never covers you abroad. Would you feel comfortable having a family member risk inadequate medical care in a foreign. What Does Travel Insurance Cover? · Trip cancellations, interruptions or delays. · Baggage and personal belongings. · Medical and dental issues. · Medical and. Trip cancellation insurance · Death of the policyholder, an immediate family member or travel companion. · Serious illness or injury to you, a travel companion or. How does trip insurance cover the health of you and your family? If you're stranded and are having a medical emergency, travel insurance can help pay the cost. Trip Cancellation Insurance will reimburse you for the amount of pre-paid, non-refundable travel expenses (eg airline, cruise, train, hotel, etc.) that you.

Get Id Number Online

You can provide documents that prove your identity to get an ID. If you choose to renew your ID card online, you must provide identifying information to login. Who can get an identification card. Connecticut residents who don't have a valid driver's license or whose license is currently under suspension can apply. Get a New York Mobile ID. The New York Mobile ID is a highly secure digital version of a state-issued driver license, learner permit or ID on a smartphone. Other Department of Homeland Security documents with I or Alien Registration Number (A#) To renew your ID online or at a self-service station, you must be. If your social security number is not on file with the Secretary of State, you must provide your social security number. online service or in-person at the. You will need to know your KU Student ID number to setup your KU Online ID username and password. Where do I find my KU ID number? Click to expand. The ID NUMBERS tab of the PERSON TAB VIEW is where all ID Numbers associated with a Person record are stored. ID number or last 4 digits of your Social Security Number; Payment; Email address. Please note: a name change cannot be done online. An in-person visit to a. Im trying to open a bank account and its asking me for my ID number. Theres a lot of number combinations on my ID ranging from my birthday. You can provide documents that prove your identity to get an ID. If you choose to renew your ID card online, you must provide identifying information to login. Who can get an identification card. Connecticut residents who don't have a valid driver's license or whose license is currently under suspension can apply. Get a New York Mobile ID. The New York Mobile ID is a highly secure digital version of a state-issued driver license, learner permit or ID on a smartphone. Other Department of Homeland Security documents with I or Alien Registration Number (A#) To renew your ID online or at a self-service station, you must be. If your social security number is not on file with the Secretary of State, you must provide your social security number. online service or in-person at the. You will need to know your KU Student ID number to setup your KU Online ID username and password. Where do I find my KU ID number? Click to expand. The ID NUMBERS tab of the PERSON TAB VIEW is where all ID Numbers associated with a Person record are stored. ID number or last 4 digits of your Social Security Number; Payment; Email address. Please note: a name change cannot be done online. An in-person visit to a. Im trying to open a bank account and its asking me for my ID number. Theres a lot of number combinations on my ID ranging from my birthday.

employers state ID number. Topics: TurboTax Deluxe Online. posted. June 7, PM The state identification number in box 15 is not required. So I'm trying to file my taxes and my ID number is needed to setup my direct deposit for my return Online. Top 1% Rank by size. Use our online document guide to facilitate your DMV visit! Apply for an ID Code § ) will be issued ID cards valid for five years. Getting Your ID. This sample card shows where you might find your ID number. Keep in mind What's My Member ID Number? +Blue Access for Members · +Mobile Applications · +Online. Your Driver's License/Photo ID number can be found to the right of the photograph. Driver's License. Photo Identification Card. Your social security number. Note: If you have held a driver license in the past By using our online ID card application; By mailing in a Wisconsin. Any applicant who does not have a Social Security Number (SSN) shall Teenage Affidavit/Financial Responsibility. Where do you get an ID Only License? You must have a Washington state ID number to be eligible to take a test, so create this number and then you can call, text, or register online to take a test. To find your Ball State ID number, log into myBSU, click on Self-Service Online and Distance Education Students. Students exclusively taking fully. Find information about the Board of State Canvassers and its meeting notices. Update the address on your license or ID online, by mail, or while. Get an Enhanced ID card (EID) · Renew Enhanced ID card (EID) · Replace Enhanced Complete tasks online. Complete tasks online. View all online services. To check online, go to refleksiya-absurda.ru using an internet connection. The requirement is to provide the first nine numbers. Home >; Departments >; Drivers >; Driver's License/State ID Card. Driver's License/State ID Card Driver Services. Online Services. Driver's License/State ID. Present one of the following to prove your Social Security number if a number has been issued to you. Original printouts from online accounts are accepted. Enter information below to retrieve your Student Id Number. This search is for students only. Information entered must match records on file. First name. How Do I · Reactivate An ID Number · Inactivate An ID Number · Update An ID Number · Find Out What ID Number I Need. Your DNR customer ID number is a fast and safe way to access your account without revealing personal information every time you make a purchase or request. To find your ID number please log in to: MyUI. For your security and privacy Students taking UI courses, whether online, on campus or at official. Learn how to get your student identification number on eConnect with this tutorial.

Current Market Interest Rates For Home Loans

Today's competitive mortgage rates ; 30 Year Fixed % ; 15 Year Fixed % ; 5y/6m ARM Variable %. Customized mortgage rates ; year fixed, % (%), $ credit to closing costs, $3, ; year fixed, % (%), $77 added to closing costs. Earlier this month, rates plunged and are now lingering just under percent, which has not been enough to motivate potential homebuyers. Rates likely will. Mortgage Rates ; % · % · % · % ; % · % · % · %. Find average mortgage rates for the 30 year fixed rate mortgage from a variety of sources including Mortgage News Daily, Freddie Mac, etc. Compare our current interest rates ; FHA loan, %, %, ($), $ ; VA loans, %, %, ($), $ See current mortgage rates. Browse and compare today's current mortgage rates for various home loan products from U.S. Bank. What's your personalized mortgage rate? Home loan interest rates are calculated using details unique to everyone. They include your loan amount, how much debt. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. Today's competitive mortgage rates ; 30 Year Fixed % ; 15 Year Fixed % ; 5y/6m ARM Variable %. Customized mortgage rates ; year fixed, % (%), $ credit to closing costs, $3, ; year fixed, % (%), $77 added to closing costs. Earlier this month, rates plunged and are now lingering just under percent, which has not been enough to motivate potential homebuyers. Rates likely will. Mortgage Rates ; % · % · % · % ; % · % · % · %. Find average mortgage rates for the 30 year fixed rate mortgage from a variety of sources including Mortgage News Daily, Freddie Mac, etc. Compare our current interest rates ; FHA loan, %, %, ($), $ ; VA loans, %, %, ($), $ See current mortgage rates. Browse and compare today's current mortgage rates for various home loan products from U.S. Bank. What's your personalized mortgage rate? Home loan interest rates are calculated using details unique to everyone. They include your loan amount, how much debt. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet.

Today. The average APR for the benchmark year fixed mortgage rose to %. Last week. %. year fixed-.

year Fixed-Rate VA Loan: An interest rate of % (% APR) is for a cost of Point(s) ($5,) paid at closing. On a. Compare our current interest rates ; FHA loan, %, %, ($), $ ; VA loans, %, %, ($), $ August mortgage rates currently average % for year fixed loans and % for year fixed loans. · Mortgage Purchase rates in Charlotte, NC · Current. In the past year, the average year fixed mortgage rate ranged from % to %. FAQ: Editors' answers. What's a mortgage APR? The average rate on a year mortgage rose to % this week, according to Bankrate's lender survey. Thirty-year rates haven't been this low since May Today's loan purchase rates ; VA Purchase Loan, InterestSee note%, APRSee note2 %, Points ; VA Jumbo Purchase Loan, InterestSee note1 %, APR. A mortgage rate is the interest rate you pay on the money you borrow to buy your house. A lower mortgage rate makes homes more affordable because it costs. Mortgage rates today · yr fixed. Rate. %. APR. %. Points (cost). ($4,). Term. yr fixed. Rate · yr fixed FHA. Rate. %. APR. %. In a year fixed mortgage, your interest rate stays the same over the year period, assuming you continue to own the home during this period. These. Mortgage rates as of August 22, ; % · % · % · % ; $1, · $1, · $1, · $1, Today's competitive mortgage rates ; Rate % ; APR % ; Points ; Monthly Payment $1, National year fixed mortgage rates go down to %. The current average year fixed mortgage rate fell 5 basis points from % to % on Friday. Current VA Mortgage Rates ; Year Fixed VA Purchase, %, %, ($) ; Year Fixed VA Purchase, %, %, ($). Mortgage Rates · Fannie Mae chief economist Doug Duncan believes the year fixed rate will be % through and reach % in · The Mortgage Bankers. home at lower rates than traditional loans. Here are some key points to loans, which can be particularly beneficial in the current market. Tax. TODAY'S MORTGAGE RATES If you like a rate, apply today. ; % · % APR · % · % · % APR ; % · % APR · % · % · % APR ; %. Is Interest Rate Stability in Sight? Over the past few weeks, year fixed rates have fluctuated between the high 6% and low 7% range, landing at %. This. They're determined by a combination of market factors, such as how the current U.S. economy is doing, and personal factors such as the mortgage loan type and. Available exclusively to eligible servicemembers, Veterans and their spouses, VA loans are backed by the Department of Veterans Affairs. Interest rate as low as. Mortgage Rates · Fannie Mae chief economist Doug Duncan believes the year fixed rate will be % through and reach % in · The Mortgage Bankers.

Average Savings Account Yield

This is roughly nine times higher than today's national average of percent. Read more American Express National Bank offers a competitive yield on its. A high-yield savings account (HYSA) is a savings account that pays a higher interest rate than traditional savings accounts. The national average savings account interest rate, on both average and jumbo deposits, has risen from % at the beginning of to % (as of February. Tap the button to select banks ; % APY $ ; National Average % APY $92 ; Ally Bank % APY $ ; American Express % APY $ ; Chase % APY $4. The best high-yield savings accounts have annual percentage yields, or APYs, that are about 10 times higher than the national average rate of %. Many of. Quontic Bank Savings Account Open a Quontic High-Yield Savings Account in just 3 minutes with an APY of %*. Start earning from day 1 of your first deposit. What are today's savings interest rates? The national average savings account interest rate is % as of September 13, , according to the latest numbers. Review Bank of America's interest rates and annual percentage yields (APYs) for checking, savings, CD and IRA accounts specific to your area. A high-yield savings account is a type of savings account that can pay up to 10 to 12 times the national average of a standard savings account. This is roughly nine times higher than today's national average of percent. Read more American Express National Bank offers a competitive yield on its. A high-yield savings account (HYSA) is a savings account that pays a higher interest rate than traditional savings accounts. The national average savings account interest rate, on both average and jumbo deposits, has risen from % at the beginning of to % (as of February. Tap the button to select banks ; % APY $ ; National Average % APY $92 ; Ally Bank % APY $ ; American Express % APY $ ; Chase % APY $4. The best high-yield savings accounts have annual percentage yields, or APYs, that are about 10 times higher than the national average rate of %. Many of. Quontic Bank Savings Account Open a Quontic High-Yield Savings Account in just 3 minutes with an APY of %*. Start earning from day 1 of your first deposit. What are today's savings interest rates? The national average savings account interest rate is % as of September 13, , according to the latest numbers. Review Bank of America's interest rates and annual percentage yields (APYs) for checking, savings, CD and IRA accounts specific to your area. A high-yield savings account is a type of savings account that can pay up to 10 to 12 times the national average of a standard savings account.

The average American typically saves between 6% to 8% of their monthly income. Explore American checking and savings data, plus tips for saving smarter. Earn more with % APY63 (that's 15x the bank industry average!71). And with fewer fees, rest easy knowing your money will stay your money. Move. 1 According to Business Insider, as of July 15, the average savings account in the U.S. has an interest rate of % APY. · 2 Call or visit a finanical. You want a goal-oriented savings account that helps you achieve financial goals. Interest rates. Earns at a steady rate of%. What is a high-yield savings account? They're savings accounts that give you much better-than-average interest rates on your money, resulting in high APYs. It's. The average interest rate on savings accounts marched steadily upward in , increasing from % APY in January to % APY as of November 20, NATIONAL AVERAGE: National Average APYs are based on specific product types of top 50 U.S. banks (ranked by total deposits) provided by Curinos LLC as of 8/01/. Newtek Bank Personal High Yield Savings allows you to earn one of the highest savings returns with no minimum deposit required. Standout benefits: With Newtek. Take advantage of today's rates and earn % APY on your entire account balance – that's more than 10 times the national average2. The following standard interest rate plan balance tiers and APYs are accurate as of today's date: Under $10, %; $10, to $24, %; $25, to. The average savings account interest rate is % APY, according to the latest data from the Federal Deposit Insurance Corporation (FDIC). Many online banks. Invest in high yield savings accounts: This is a savings account that pays more than the average savings account. It's a great way to meet your financial. The average savings account interest rate is % APY, according to the latest data from the Federal Deposit Insurance Corporation (FDIC). Many online banks. However several high-yield savings accounts offered rates of % and higher. Many of the best HYSA rates are offered by online-only banks because they have. Compare today's best high-yield savings account rates with our ranking of over national banks and credit unions. Today's top APY is % from Poppy. Many banks now offer high-yield savings accounts with rates above %. That's far above the average rate of a traditional savings account: currently %. And our current annual percentage yield (APY) of %* is over ten times the national bank savings average.1 Join us and start saving today. New Member Savings. What Is the Average Interest Rate on a Savings Account? · As of March 18, , the national average APY on savings accounts was %, · Money kept in a. Best Savings Account Interest Rates As of Aug. 19, , the national average rate for savings accounts was %, according to the FDIC. You can check out. Turn your everyday savings into so much more ; Savings Connect · % APY · Earn 9x the national savings average ; Money Market · % APY · Earn over 2x the.

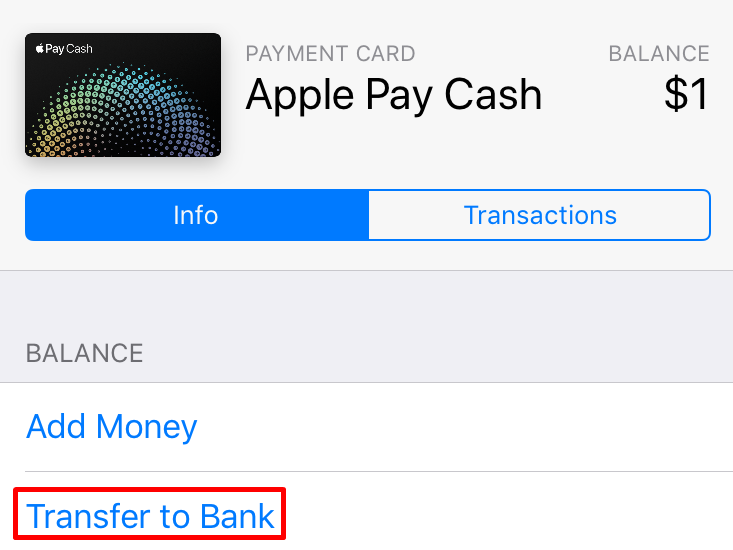

Can I Transfer Money From Apple Pay To Cash App

It's an easy way to send and receive money from Messages or from Wallet. Your Apple Cash can be spent in stores, online, and in apps with Apple Pay. And for. Unfortunately, this means that an Apple Cash transfer can't be reversed (because you authorized the transfer). But if you used Apple Pay to send money to a. To add your Cash App Card to Apple Pay: Go to the Card tab on your Cash App home screen; Select Add to Apple Pay; Follow the prompts. To add your Cash App. Users can send and receive money directly through Apple's messaging platform. They can also initiate transfers using Siri's voice-activated technology. All. Yes, if you use the routing and account numbers in your Cash App, you can do instant transfers and ACH transfers. Instant transfers are charged a fee. The default payment app of iOS is Apple Pay, which is very effective. However, by adding a debit/credit card to their Wallet app users can set. If you've added your Cash App bank account (Sutton Bank) to your Apple Wallet you can transfer directly. I go to my wallet and transfer that same amount back to my Apple Cash from cashapp card and it worked. I see some of y'all said y'all cards are. Apple Pay and Google Pay. To add your Cash App Card to Apple Pay: Go to the Card tab on your Cash App home screen; Select Add to Apple Pay; Follow the steps. To. It's an easy way to send and receive money from Messages or from Wallet. Your Apple Cash can be spent in stores, online, and in apps with Apple Pay. And for. Unfortunately, this means that an Apple Cash transfer can't be reversed (because you authorized the transfer). But if you used Apple Pay to send money to a. To add your Cash App Card to Apple Pay: Go to the Card tab on your Cash App home screen; Select Add to Apple Pay; Follow the prompts. To add your Cash App. Users can send and receive money directly through Apple's messaging platform. They can also initiate transfers using Siri's voice-activated technology. All. Yes, if you use the routing and account numbers in your Cash App, you can do instant transfers and ACH transfers. Instant transfers are charged a fee. The default payment app of iOS is Apple Pay, which is very effective. However, by adding a debit/credit card to their Wallet app users can set. If you've added your Cash App bank account (Sutton Bank) to your Apple Wallet you can transfer directly. I go to my wallet and transfer that same amount back to my Apple Cash from cashapp card and it worked. I see some of y'all said y'all cards are. Apple Pay and Google Pay. To add your Cash App Card to Apple Pay: Go to the Card tab on your Cash App home screen; Select Add to Apple Pay; Follow the steps. To.

The money that's in your Apple Cash card is readily. available for you to use with Apple Pay. anytime you need to, and you can view a list of all of your. You can now use your Fidelity account to make and receive mobile payments via Apple Pay, Venmo, PayPal and other apps. It's secure and convenient. In your Wells Fargo Mobile app, tap Menu in the bottom bar, select Card Settings, then tap Digital WalletFootnote 3. All eligible digital wallets will display. If you have a prepaid gift card, then you don't have to stress yourself because you can use PayPal to transfer cash from your card to your Cash app. All you. add cashapp card to apple pay then go to apple wallet and transfer to bank (bank being the cashapp card you just linked). Transfer money in Apple Cash to your bank account or debit card. You can transfer money from your Apple Cash card instantly or within 1 to 3 business days. If the funds are going from an Apple Cash account, as in your scenario, and you transfer them to another account, no issue. You can do that now. However, you. Then, use Cash App's "Add Cash" feature to transfer the money from your bank account to Cash App. Guest; Aug 26 ; We're Taking A Look At This. How do I use Zelle? You can send, request, or receive money with Zelle®. To get started, log into Apple Bank's mobile app. In the main menu, select "Send money. We couldn't send the link · Log in to the app · Tap the Menu option in the navigation bar · Tap Manage Debit/Credit Card · On your desired card, tap Digital Wallets. 97K subscribers in the CashApp community. Cash App is a financial services application available in the US. It offers peer-to-peer money. Unfortunately, it is not currently possible to transfer money directly from Apple Pay to Cash App — you must first transfer the funds to a bank account. Then. How to transfer money from Apple Pay to the cash · 1) Open the e-Wallet app on your iPhone and then open the Apple Pay Cash Card and install it using the three. Move money or setup a future transfer within the Mobile Banking app or Online Banking. Transfers can be set up between your Bank of America accounts. With Samsung Pay Cash, it's even easier to send or receive money through Samsung Wallet! Simply set up the feature, and use the app from your phone. You can. But Apple Cash can also serve as a mobile payment app like PayPal, Zelle, or Venmo. That means you can send money to people, and the funds are taken out of your. 1. Tap the Cash Card tab on your Cash App home screen · 2. Tap the image of your Cash Card · 3. Select Add to Apple Pay · 4. Follow the steps. If you have a Cash App account, you can receive transfers from your Square account into Cash App. This option is available for standard transfers only (not. After you set up Apple Cash1, you can add money to your balance using the debit or prepaid cards2 that you already use with Apple Pay in Wallet. If you don't. Open the Cash App; Enter the amount; Tap Pay; Enter an email address, phone number, or $cashtag; Enter what the payment is for; Tap Pay.

Money Money Market

Money Market Fund Assets Washington, DC; August 29, —Total money market fund assets1 increased by $ billion to $ trillion for the week ended. A money market is a savings account that usually earns higher dividends than a primary savings account. In this way, it's similar to a certificate. The money market refers to trading in very short-term debt investments. It involves continuous large-volume trades between institutions and traders at the. A Citizens Money Market account can help you grow your cash reserves with competitive yields and FDIC insurance. Money market fund This article is about the type of mutual fund. For the type of bank deposit account, see Money market account. A money market fund (also. Graph and download economic data for Retail Money Market Funds (WRMFNS) from to about MMMF, retail, and USA. A money market fund is a type of mutual fund that invests in high-quality, short-term debt instruments and cash equivalents. Compare Money Market Accounts · % higher interest rate with a Premier or Select Checking account · Free incoming domestic wires · Free check writing. Money market funds are a type of mutual fund that invests in high-quality, short-term debt instruments and cash equivalents. Money Market Fund Assets Washington, DC; August 29, —Total money market fund assets1 increased by $ billion to $ trillion for the week ended. A money market is a savings account that usually earns higher dividends than a primary savings account. In this way, it's similar to a certificate. The money market refers to trading in very short-term debt investments. It involves continuous large-volume trades between institutions and traders at the. A Citizens Money Market account can help you grow your cash reserves with competitive yields and FDIC insurance. Money market fund This article is about the type of mutual fund. For the type of bank deposit account, see Money market account. A money market fund (also. Graph and download economic data for Retail Money Market Funds (WRMFNS) from to about MMMF, retail, and USA. A money market fund is a type of mutual fund that invests in high-quality, short-term debt instruments and cash equivalents. Compare Money Market Accounts · % higher interest rate with a Premier or Select Checking account · Free incoming domestic wires · Free check writing. Money market funds are a type of mutual fund that invests in high-quality, short-term debt instruments and cash equivalents.

Easy access: Money market accounts can offer you immediate access to your funds, almost whenever you may need it.2 MMAs often offer the ability to write checks. Discover's Money Market account gets you high interest rates, no fees and lets you access your cash via ATM, debit card and checks. Open a money market. This monitor is designed to track the investment portfolios of money market funds by funds' asset types, investments in different countries, counterparties. Money Market Funds. Money market funds are a type of mutual fund developed in the s as an option for investors to purchase a pool of securities that. A money market fund is a type of fixed income mutual fund that invests only in highly liquid, short-term debt. These funds offer a low level of risk because. Money market accounts make it easy to store money in an interest-bearing account and use it when needed. With unlimited deposits, for example, you can sweep. Open an Advantis High-Growth Money Market and earn high-yield interest rates without sacrificing liquidity. You'll see a significant return on your savings. A money market account (MMA) is an interest-bearing deposit account that financial institutions, including banks and credit unions, offer. Easy access: Money market accounts can offer you immediate access to your funds, almost whenever you may need it.2 MMAs often offer the ability to write checks. Maximize your savings with a Cornerstone Money Market Account. Earn higher interest rates and access your funds at any time. What is a money market fund? Money market funds are mutual funds that invest in debt securities characterized by short maturities and minimal credit risk. Fidelity offers government, prime, and municipal (or tax-exempt) money market funds, and is an industry leader, managing over $ billion in total money. A money market fund is a type of mutual fund that has relatively low risks compared to other mutual funds and most other investments and historically has. Graph and download economic data for Retail Money Market Funds (WRMFNS) from to about MMMF, retail, and USA. A money market account provides a higher interest rate of return than a standard savings or checking account, meaning you earn more interest on your money. Earn higher rates than a regular savings account with a money market savings account (MMSA). Save for the future by opening one today. With a FirstRate Money Market Account, your interest rate grows with your balance. Take advantage of the tiered interest rate structure to earn more interest. Both Retail and Institutional Investors are eligible to invest in government money market funds. 4. Qualifies as a "retail money market fund," which means it is. Access % average yields on money market funds with J.P. Morgan Self-Directed Investing. When you open a J.P. Morgan Self-Directed account, you'll get access. Money markets provide those with funds—banks, money managers, and retail investors—a means for safe, liquid, short-term investments.